Residential property taxes in James City County jump by 21%

JAMES CITY COUNTY – Residential property values in James City County are up by more than 21% overall, according to the newest assessment by the county. The increase means many homeowners will face a jump in taxes they may not have been prepared for.

During the Feb. 27 Board of Supervisors meeting, Dayle Gallagher, the county’s director of real estate assessments, said the median value of homes in James City County now stands at $411,200. That’s a significant increase from 2023, when the median home value was $334,100.

The real estate tax rate in the county is currently $0.83 per every $100 of assessed valuation.

Property taxes are calculated by multiplying the assessed, taxable property values by the mill rate and then dividing that sum by 1,000, according to Investopedia. Local governments set mill rates based on their jurisdiction’s total value of properties in order to provide the tax revenue necessary to fund their projected budget.

In an example shown by Gallagher, a homeowner whose property is in line with the median value would pay $3,413 per year in taxes, up from $2,773 per year. The difference, in that example, amounts to a monthly tax hike of about $53 per month, or an extra $640 per year, based on the current mill rate.

Another example showed a breakdown of value changes by neighborhood. Town houses in New Town, for instance, went up by an average of 21%, for a median assessment value of $457,300. Gallagher said the increases there were partially driven by the construction of new, more expensive homes in the neighborhood.

Homes in the Fenwick Hills neighborhood increased in value by 28%, and properties in the Wellington neighborhood jumped by an average of 16%.

Gallagher said the county’s real estate assessments department is prepared for homeowners to have questions about why their rates have risen so dramatically.

“People will get the notice and want to know why [their rates] went up,” Gallagher said. “The first thing we do is ask them to look at some of the sales that have happened in their neighborhood.”

Only people whose reassessments have changed will receive the notice, according to Gallagher.

Residents took to social media to sound off about their frustrations surrounding the assessment hikes and resulting higher taxes.

“[A] 21% increase is insane,” said resident Keith Rowe on Nextdoor. “It’s not easy for all us retired people on fixed incomes.”

Some people said their assessments went up significantly more than 21%, with several residents lamenting that their property value increased by more than 30%.

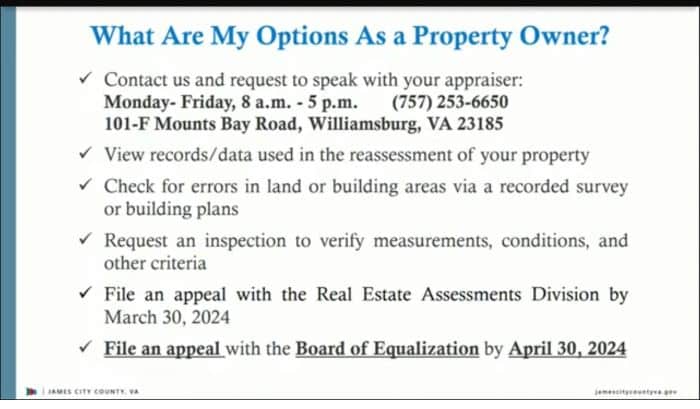

Homeowners have the right to appeal the assessment decision if they disagree with it. The appeal period began March 1 and lasts for thirty days until March 30.

In most cases, an appeal will prompt an explanation about how the number was determined. The appraiser may also have a conversation with the property owner to make sure the county has the correct data about the home, including accurate details about square footage, according to Gallagher.

Several factors often impact value increases for homes, such as home expansions or the addition of bathrooms, fireplaces or outbuildings.

If the county verifies that their data on the home is correct and the homeowner still disagrees with the assessment, the case may be brought before the Board of Equalization for further review. The board consists of local real estate experts who are selected by the Board of Supervisors and then appointed by a circuit court judge.

In the Feb. 16 episode of the This Week in James City County podcast, Sharon McCarthy, director of financial and management services, said the assessments are based on data.

“There’s not a personal bias that goes behind the numbers,” McCarthy said. “We’re not given a goal and trying to chase down a certain number in revenue or those types of things. It’s really a bunch of equations and ratios and making sure that we really have accurate property data.”

McCarthy said that broader, market-related factors have also led to major shifts in the values of homes in James City County and beyond.

“We’re in a very different market now than we used to be,” McCarthy said.

For more information about James City County’s real estate assessments, click here.

Thanks for reading! Will you help make our journalism possible?

The Triangle is a uniquely independent news source for Virginia's Historic Triangle and the surrounding region. We need our community's support to keep producing quality local journalism.