City of Williamsburg meals tax now among the highest in the U.S.

WILLIAMSBURG – The City of Williamsburg ranks among the top of a new nationwide list, but this one doesn’t come with any bragging rights.

Following a vote by City Council on Jan. 8, the locality now has one of the highest meals tax rates in the county.

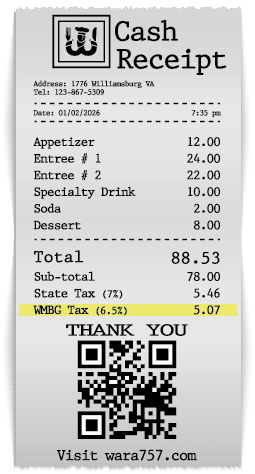

Council members approved a budget proposal to increase the meals tax to 6.5%, up from 5%. That’s on top of the existing state sales tax of 7%, bringing the combined levy to 13.5%.

The decision comes several months after more than a dozen local restaurant owners spoke out against the proposal, saying the higher rate would harm their small business at a time when inflation and reduced foot traffic are already squeezing profits.

Many worry the increase could cause local residents to take their business to neighboring localities where taxes are lower.

City Manager Andrew Trivette recommended the hikes upon the rollout of his Fiscal Year 2026 budget, saying the city has recently endured “economic cooling,” leading to slower revenue growth.

The added tax revenue will make it possible for the city to meet its funding obligations for capital projects while supporting infrastructure upgrades, Trivette said. He underscored that construction costs have substantially increased since the pandemic, straining the city’s finances.

In addition to raising the meals tax, the City Council voted to increase the lodging tax by 2% and implement a brand new 10% admissions tax for city events.

The budget was approved in May, but council members agreed to refrain from voting on the controversial service industry tax proposals until January.

The new taxes are effective immediately.

What local restaurant owners are saying

The Williamsburg Area Restaurant Association (WARA) has strongly opposed the higher meals tax, saying the hikes could “devastate small, independent businesses and the workers who depend on them.”

Noreen Graziano, who was president of WARA during the budget discussions last year, argued the heightened costs will reduce visitation to local restaurants and directly impact their profits.

“Local restaurants are already faced with rising food prices, increased spending for staff, decreased visitation and increased credit card fees,” Graziano said. “Patrons of the restaurants are both locals and tourists. We feel the increase in the meals tax… will drive locals out of visiting city restaurants.”

The 1.5% jump represents a 30% increase over the previous rate, she emphasized.

Neil Griggs, chef and owner of Cochon on 2nd and Moody’s Kitchen, urged fellow restaurateurs to oppose the meals tax increase, saying the higher costs could cripple the industry and discourage new dining establishments from opening in Williamsburg.

“If taxes rise while businesses slash prices to survive, how will we attract the next generation of entrepreneurs?” Griggs wrote in a letter sent to fellow WARA members. “Without change, local spirit will be replaced by national chains, with corporate headquarters in another state. Entrepreneurs will see Williamsburg as too risky because the [City Council] believes that while we are lowering our prices, they can raise them on our behalf.”

New lodging and admissions taxes also divisive

Some residents and stakeholders expressed opposition to the lodging and admissions taxes, fearing their potential impact on the local tourism industry.

Ellen Peltz, who served as The Colonial Williamsburg Foundation’s spokesperson through November 2025, told The Triangle the city’s tax increases “jeopardize the work” of the Foundation and will be detrimental to other local businesses.

“As the city’s largest taxpayer, Colonial Williamsburg and its guests will bear the brunt of these substantial tax hikes – but they also will hurt many other businesses across the city,” Peltz said. “Williamsburg will see a drop in commerce, and we will see local and tourism spending flow to neighboring counties which will have substantially lower tax rates.”

On the flip side, Ron Kirkland, executive director of the Williamsburg Hotel & Motel Association, was mostly supportive of the proposed lodging tax increase. He argued that a property tax hike would have been more harmful to his industry.

During the City Council meeting on Jan. 8, Kirkland said that while “nobody likes taking money out and paying taxes,” he appreciated that taxpayer funds make it possible for the city to maintain a high quality of life for residents.

“Over the last 20-plus years, what I have enjoyed is driving to work to Williamsburg every day on nicely maintained streets and safe streets. I don’t have to worry about getting mugged,” Kirkland said. “We were able to avoid a property tax increase for our industry, which has a real negative effect on the bottom line.”

The City Council also voted in favor of the proposed 10% admissions tax, which applies to most events within the city, with the exception of school-sponsored activities.

In the original budget proposal, the tax was set to be levied on the full admission price of applicable events. However, council members asked staff to cap the tax at the first $10 of the sale of every ticket. That means the tax will not exceed $1 per ticket under the revised ordinance.

Robert McNab, chairman of the Department of Economics at Old Dominion University, told The Triangle that localities implement lodging and admissions taxes in an effort to take in more revenue from visitors and tourists rather than placing the tax burden solely on residents.

Nonetheless, he acknowledged the hikes could be risky given the fact that tourism has been slowing nationwide amid economic uncertainty.

“Levying taxes on visitors is a strategy of collecting revenue without having to provide services to the visitors,” McNab said. “The open question is how responsive tourism is to an increase in price.”

How the new meals tax compares to other cities

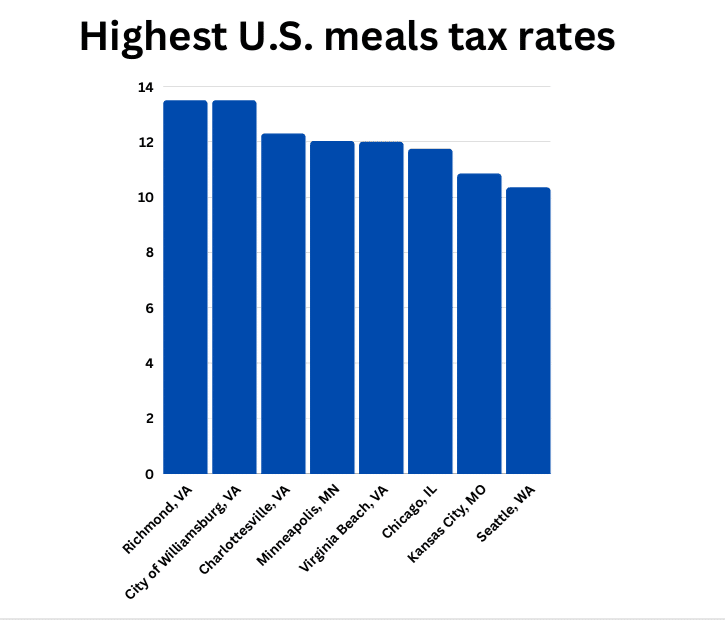

Cities in Virginia already have some of the highest meals taxes in the United States, and now Williamsburg stands notably at the top of the pack.

The increase comes at a time when Americans are paying more for restaurant meals than ever before, according to the nonprofit Tax Foundation.

Virginia levied a Historic Triangle regional sales and use tax of 1% starting in 2018. That brings the general sales tax rate to 7% for the City of Williamsburg, York County and James City County.

When the new meals tax of 6.5% is factored in, the total tax for all prepared food sold in the city jumps to 13.5%.

That’s higher than Minneapolis, MN, which – with a combined rate of 12.03% – has the most expensive meals tax in the nation outside of Virginia among large U.S. cities.

Other cities with the highest meal tax rates include Chicago, IL, at 11.75%; Kansas City, MO, at 10.85% and Seattle, WA, at 10.35%, the Tax Foundation states.

Virginia Beach garnered national media attention after officials voted last year to raise the city’s meals tax, which is already notoriously one of the highest in the country.

The combined levy in the city increased to 12% – up from 11.5% – amid the Virginia Beach City Council’s passage of a new budget that went into effect on July 1 of last year. That rate is still lower than the City of Williamsburg’s.

The Virginia Beach Restaurant Association has since launched a petition to repeal that increase, saying the tax hike “doesn’t just hurt restaurants—it impacts every consumer who purchases a prepared meal, from family-owned or national chain restaurants to grocery stores to fast-casual favorites.”

Echoing the reasons the Williamsburg City Council cited for their vote to raise the meals tax, Virginia Beach officials said the coastal city is similarly experiencing inflation-driven cost increases related to capital projects.

Richmond and Charlottesville are also at the top of the pack for meals tax rates nationwide. Richmond’s combined rate is the same as Williamsburg’s – 13.5% – while Charlottesville’s is 12.3%.

Impacts on residents

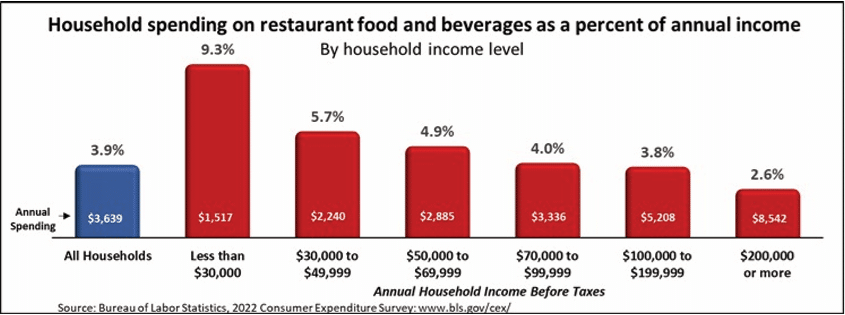

While the meals tax burden is shared by tourists and out-of-town visitors, data shows that the levy can have considerable impacts on residents and the small businesses they support.

According to the National Restaurant Association, 70% of checks between $15 and $25 are paid by residents. That number increases to 85% for smaller orders of $8 or less, such as morning coffee or takeout lunch.

Increasing the meals tax also disproportionately impacts lower-income residents since those households spend the largest portion of their income on restaurant food and beverages, the Association states.

Meals taxes go beyond just dining out

The passage of the new food and beverage tax ordinance means consumers will pay more for all prepared meals and beverages, not just those eaten at restaurants.

The levy applies to all “meals purchased from any food establishment, whether prepared in such food establishment or not, and whether consumed on the premises or not,” according to the ordinance.

That means costs will increase not only for formal and informal in-person dining but also for fast food, café sales, carry-out items, to-go orders, food truck purchases, catered meals and all food or beverages ordered for delivery.

Some citizens push for spending decreases

Residents were divided during the budget session about whether to raise property taxes instead of implementing meals and lodging tax increases. However, some suggested that the most logical solution is to cut spending.

Prior to the City Council vote on Thursday, resident Sabrina Fairbanks said many locals want the city to rein in spending on major new capital projects.

The request was reminiscent of the pleas of James City County citizens who have voiced frustration with the county’s decision to move forward with a $189 million government complex, leading to higher real estate taxes there.

“Minimum wages are going up. The cost of food… is rising,” Fairbanks said. “I feel like these [new taxes] are going to be a burden to the businesses, and I think they’ve made that very clear at all the meetings that I’ve attended.”

Fairbanks said she worries the meals tax will drive down food sales at local dining establishments. The city, she added, could have largely avoided instituting tax increases altogether by scaling back spending on some Capital Improvement Projects (CIPs).

“The crux of this is to help fund the CIPs that are on the books,” Fairbanks said. “The one thing we can agree on – the business owners and the residents – is that we would like the city to look more at cutting the expenditures” for capital projects.

What council members are saying

The City Council responded to restaurant operators’ concerns by providing a 2% dealer discount for meals, lodging and admissions tax payments. The discount allows the city to compensate the hotels and restaurateurs for the credit card fees they collect, according to Trivette.

Officials also agreed to adjust the meals tax rate to 6.5%, down from the 7% that was originally proposed at the start of the FY 2026 budget discussions.

Council members had little to say at the Jan. 8 meeting regarding their decision to approve the new taxes. The vote was unanimous.

Mayor Douglas Pons stressed that the council extensively discussed the budget proposal last spring before agreeing to move forward with it.

“We certainly felt that this decision was the best way to meet the needs of the city,” Pons said.

Vice Mayor Pat Dent added that while “nobody likes a new tax or increased tax,” the alternative of raising property taxes would have created too much of a burden on all city residents.

“It would be a significant real estate tax increase to make up the revenue that would generate from these additional [meals, lodging and admissions] taxes,” Dent said. “I think there have been healthy discussions, but we’re at a point where we approved a budget based on these revenues coming in.”

Council member Ayanna Williams said that while the tax hikes are “not the most exciting thing” to support, they are “definitely necessary.”

Up next: All eyes on James City County

James City County currently has a 4% meals tax rate. Counties in the Commonwealth are subject to different restrictions than cities and are not allowed to raise the meals tax rate above 6%, per the Code of Virginia.

While the county has not yet made any moves to increase the tax, the Board of Supervisors began debating the topic last year.

During a meeting in April, County Administrator Scott Stevens said a meals tax hike should be on the table during the upcoming budget discussions.

“I would suggest you maybe consider [increasing the meals tax] in the next budget year,” Stevens told the supervisors.

The comment came after the supervisors faced widespread scrutiny over their decision to raise property tax rates amid significantly higher recent real estate assessments.

Stevens said additional meals tax revenue could be used to help offset Williamsburg-James City County Schools’ budget shortfall. The division received nearly $2 million less than it requested from the localities last year.

“As we get into school funding, one of our recommendations there would be to use some fund balance and let this meals tax be that ongoing revenue replacement in the future,” Stevens said.

Supervisor Michael Hipple, who retired on Dec. 31 and passed the torch to newcomer Tracy Wainright, said a meals tax increase might be a good idea because it would be paid “not only by our citizens but by anybody coming through our area.”

In a letter to WARA, Stevens explained that discussions surrounding changes to the meals tax rate will likely begin in the spring of 2026.

“If the Board of Supervisors were to change any of our current tax rates, that would be discussed as part of their FY 2027 Budget discussion that would occur in April and May,” Stevens said.

Thanks for reading! Will you help make our journalism possible?

The Triangle is a uniquely independent news source for Virginia's Historic Triangle and the surrounding region. We need our community's support to keep producing quality local journalism.